Revolut: Send, spend and save app for iPhone and iPad

Developer: Revolut Ltd

First release : 01 Mar 2015

App size: 460.18 Mb

Join the 50+ million customers worldwide who use our app to spend, send, and save smarter.

Make your spend, well-spent

Pay any way, with physical cards, virtual cards, single-use virtual cards for extra protection, Google or Apple Pay

Spend abroad with great exchange rates (fees additional to the rate provided may apply)

Access 55+ K in-network ATMs worldwide with no fees

Link your external bank accounts to stay on top of all your spending

Design a physical card you vibe with (fees may apply).

Set your kids up for financial success. Get them a Revolut <18 account, with their own card, so they can learn about money in a safe and fun way

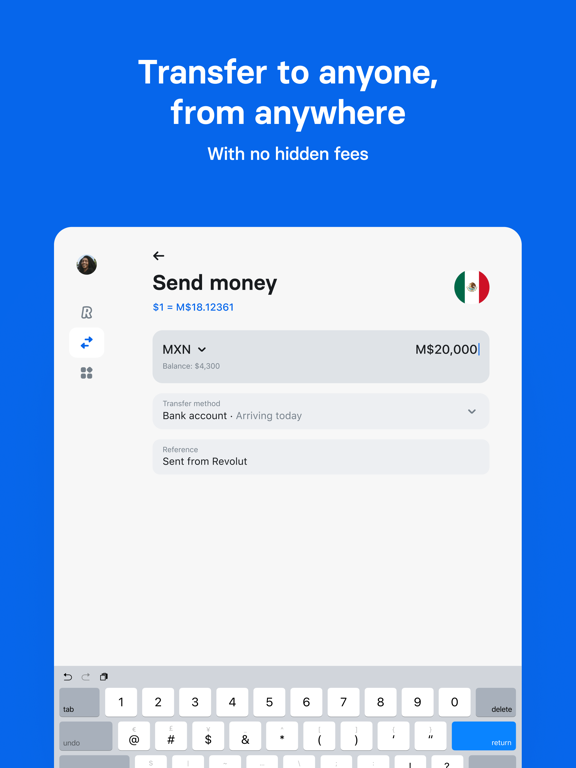

Send money near, far, wherever they are

Request or send 25+ currencies with a tap to anyone, anywhere

Chat, send, and receive money, in one place. Whatever your plans, transfers are almost instant between your Revolut friends with P2P payments

Split and settle bills in one place. You can even share a fun GIF to diffuse any tension

Save the interest-ing way

Grow your money with up to 4.25%* APY with Savings Vaults, Access your savings whenever you need to, with zero penalties or fees

Build your savings effortlessly — set up recurring transfers and round up spare change to stash cash

Explore Stock Trading (capital at risk)

Start trading stocks from $1 (other fees may apply)

Choose from 2,000+ stocks to invest in some of the worlds most popular companies

Enjoy no-commission stock trading within your monthly allowance (other fees may apply)

All investments involve risk, including possible loss of principal. Investment accounts and disclosures may be displayed together. Self-directed brokerage products are provided by Revolut Securities Inc., member FINRA/SIPC. Brokerage Products • Not FDIC Insured • No Bank Guarantee • May Lose Value. Automated investing is provided by Revolut Wealth Inc, an SEC-registered investment adviser.

End the overspend

Get instant spending notifications to keep track of every payment

Use smart budgeting and analytics tools to stop wondering where your money went, and start telling it where to go

Worried about missing upcoming payments or subscription charges? Dont be — well notify you beforehand

Upgrade to one of our paid plans to get exclusive cards, more benefits, and even cooler perks. Pick the plan thats right for you: Premium or Metal (Paid Plan T&Cs and subscription fees apply).

Unlock security features that you control

Freeze and unfreeze your card in a tap

Use single-use cards with new details generated each time you use it, for an extra layer of protection

Set spending limits and get notifications to keep track of your money

How we protect your money

Our sophisticated fraud prevention system flags high-risk transactions and pings you an alert, so you can spot scams, and nip em in the bud

Extensive identity verification keeps sign-ups secure, and your account is protected with passcodes and biometrics

Were available 24/7 via our in-app customer support

Funds in your Revolut Prepaid Card Account are held at or transferred to Lead Bank, Member FDIC, and are insured by the FDIC up to $250,000 applicable limits by the FDIC in the event Lead Bank fails if specific deposit insurance requirements are met. See FDIC-Prepaid Cards and Deposit Insurance Coverage.

California Privacy Notice: https://www.revolut.com/en-US/legal/privacy

*The highest APY is available to users on a Premium or Metal plan. Annual Percentage Yield (APY) is a variable rate and subject to change. These APYs are accurate as of October, 20th, 2023. Monthly fees apply for Premium and Metal plans. Terms and Conditions Apply. No minimum amount required. Savings Vault services provided by Sutton Bank, Member FDIC

Revolut Ltd (No. 08804411) is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011 (Firm Reference 900562). Registered address: 107 Greenwich Street, 20th Floor, New York, NY 10006